Before

Long-Term Incentive Program

The long-term incentive program is designed to drive achievement of long-term operational and financial goals and increased shareholder value, as well as to encourage retention of key talent over a sustained time period. During 2020, our long-term incentive awards consisted of equity and cash-settled awards, described further below.

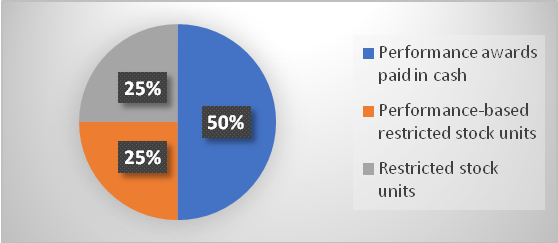

- Performance Awards. Performance awards which comprised 50% of each executive’s long-term incentive award in 2020, reward executives to the extent that the Company meets or exceeds the Company’s performance goals for each three-year performance period. The Compensation Committee sets performance targets at the beginning of each period based on the Company’s long-range business plan. Final payouts for the 2020-2022 performance period may range from 0% to 150% of initial award value. Performance awards are designed to pay 100% of the initial award value at the end of the three-year performance cycle if performance goals are achieved at target. Payment, if earned, is made in cash. Performance awards granted for the 2020-2022 performance period will pay out, if earned, based 50% on free cash flow, 25% on core EPS, and 25% on revenue, over the three-year performance period.

- Performance-Based Restricted Stock Units. PBRSUs, which comprised 25% of each executive’s long-term incentive award in 2020, are designed to align our executives’ interests with those of our shareholders by tying award payout levels to TSR performance as compared to the companies against which we compete for customers, capital and/or executive talent. For our 2020 PBRSU awards, TSR performance at less than the 25th percentile will result in a 0% payout, up to a maximum payout of 200% for performance at or exceeding the 95th percentile. PBRSUs will be paid out in shares at target for TSR performance at the 55th percentile, and straight line interpolation will be used to determine the payout level for performance between the 25th and 55th percentiles, and between the 55th and 95th percentiles.

- Restricted Stock Units. RSUs, which comprised 25% of each executive’s long-term incentive award in 2020, are designed to encourage executive retention and reward continued performance. The ultimate value realized upon vesting (three years after the grant date) is based on the stock price, driving increased focus on sustainable business performance.

[366 words]

Before, with commentary

Long-Term Incentive Program

The long-term incentive program is designed to drive achievement of long-term operational and financial goals and increased shareholder value, as well as to encourage retention of key talent over a sustained time period. During 2020, our long-term incentive awards consisted of equity and cash-settled awards, described further below.

- Performance Awards. [Generally speaking, you should use either a bullet or a header, not both. Bullets are good for short phrases—perhaps even whole sentences, but not full paragraphs. This discussion deserves a section to itself.] Performance awards, which comprised [see this tip, on why nothing is ever comprised of anything] 50% of each executive’s long-term incentive award in 2020 [There is a clause like this for each type of award. They can all be replaced by a simple graphic.], reward executives to the extent that the Company meets or exceeds the Company’s performance goals for each three-year performance period. The Compensation Committee sets performance targets at the beginning of each period based on the Company’s long-range business plan. Final payouts for the 2020-2022 performance period may range from 0% to 150% of initial award value. Performance awards are designed to pay 100% of the initial award value at the end of the three-year performance cycle if performance goals are achieved at target. Payment, if earned, is made in cash. Performance awards granted for the 2020-2022 performance period will pay out, if earned, based 50% on free cash flow, 25% on core EPS, and 25% on revenue, over the three-year performance period. [These few sentences contain several details that are effectively buried when presented like this. This is where simple graphics are useful.]

- Performance-Based Restricted Stock Units. [Like the section above, this should be independent, not a bulleted paragraph.] PBRSUs, which comprised 25% of each executive’s long-term incentive award in 2020, are designed to align our executives’ interests with those of our shareholders by tying award payout levels to TSR performance as compared to the companies against which we compete for customers, capital and/or executive talent. For our 2020 PBRSU awards, TSR performance at less than the 25th percentile will result in a 0% payout, up to a maximum payout of 200% for performance at or exceeding the 95th percentile. PBRSUs will be paid out in shares at target for TSR performance at the 55th percentile, and straight line interpolation will be used to determine the payout level for performance between the 25th and 55th percentiles, and between the 55th and 95th percentiles. [Important details are buried.]

- Restricted Stock Units. [Like the section above, this should be independent, not a bulleted paragraph.] RSUs, which comprised 25% of each executive’s long-term incentive award in 2020, are designed to encourage executive retention and reward continued performance. The ultimate value realized upon vesting (three years after the grant date) is based on the stock price, driving increased focus on sustainable business performance.

After

Long-Term Incentive Program

The long-term incentive program is designed to drive achievement of operational and financial goals and increased shareholder value, and to encourage key talent to remain with the Company. As described below, during 2020, our long-term incentive plan consisted of equity and cash-settled awards, allocated as follows:

Performance awards paid in cash. Performance awards reward executives to the extent the Company meets or exceeds defined performance goals for the three-year performance period. The Compensation Committee sets performance targets at the beginning of each period based on the Company’s long-range business plan. Performance awards granted for the 2020-2022 performance period will pay out, if earned, based results for three metrics:

| Metric | Weight |

| Free cash flow | 50% |

| Core EPS | 25% |

| Revenue | 25% |

Final payouts for the 2020-2022 performance period may range from 0% to 150% of initial award values, with payouts equal to 100% of the initial award value if the Company achieves performance goals at target.

Performance-Based Restricted Stock Units. PBRSUs are designed to align our executives’ interests with those of our shareholders by tying award payout levels to TSR performance as compared to TSR for the companies against which we compete for customers, capital, or executive talent. Payouts for our 2020 PBRSU awards, which are made in shares of common stock, will vary as shown below.

| TSR percentile relative to peers | Payout percentage* |

| < 25th | 0% |

| 55th | 100% |

| > 95th | 200% |

*Straight-line interpolation will be used to determine payouts for results between targets.

Restricted Stock Units. RSUs are designed to encourage executive retention and reward sustained business performance. These awards vest three years after the grant date, with the ultimate value realized based on the stock price.

[279 words]